Get Help Financing Your Car

Use our auto loan calculator and see why AAA Members choose us for financing.

Get tips to steer clear of these missteps.

Dan Page

Dan Page

Choosing the best way to finance a car is a difficult decision, but it’s one that heavily influences whether you overpay for your new ride. To help you make an informed choice, here are common auto loan mistakes and what you can do to avoid them.

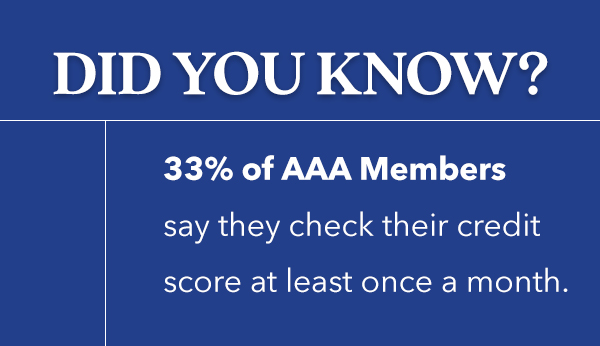

Source: AAA Consumer Pulse survey

Source: AAA Consumer Pulse surveyYour credit score—the number that rates the likelihood that you’ll pay back a loan-is the primary factor in determining your interest rate. A credit score lower than you expected could result in higher payments than you planned—or it could even prevent you from qualifying for a loan.

How to avoid: Find out what your credit score is before visiting a dealer’s lot so you can anticipate whether you will qualify for special offers.

Great rates on auto loans are part of the benefits designed for you from AAA.

Learn MoreAlthough getting your auto loan through the dealer is easy since you’re already there, it can often be more expensive. The dealer’s interest rates tend to be higher than those offered by other institutions and may include a markup. Limiting yourself to what’s available on-site could mean missing out on big savings.

How to avoid: The best way to finance a car? Shop around to find the best interest rate for your loan. Online lenders and credit unions typically offer much lower rates than a dealer.

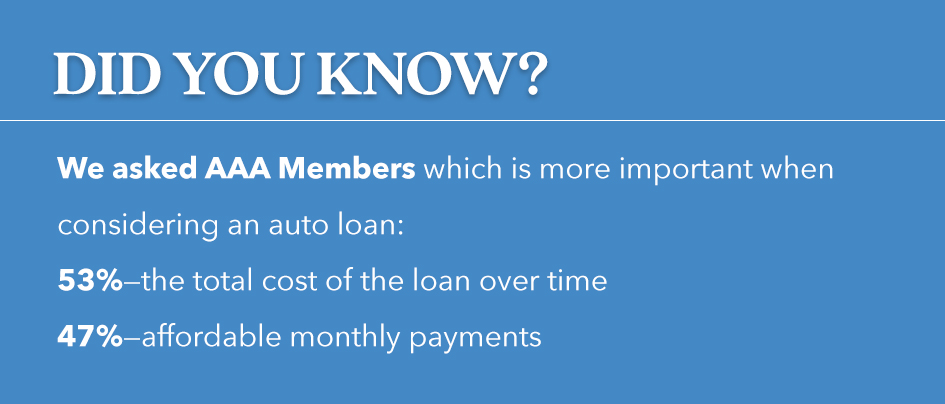

Source: AAA Consumer Pulse survey

Source: AAA Consumer Pulse survey

Your monthly payment must fit your budget, but not at the expense of getting a car loan that is excessively long. Longer loans come with higher interest rates, meaning you will pay more to purchase your vehicle.

How to avoid: Focus on the car’s price and the total cost of financing for the life of the loan. Also, keep the maximum of what you can afford to yourself when you are in the dealership—it’s not something the dealer needs to know.

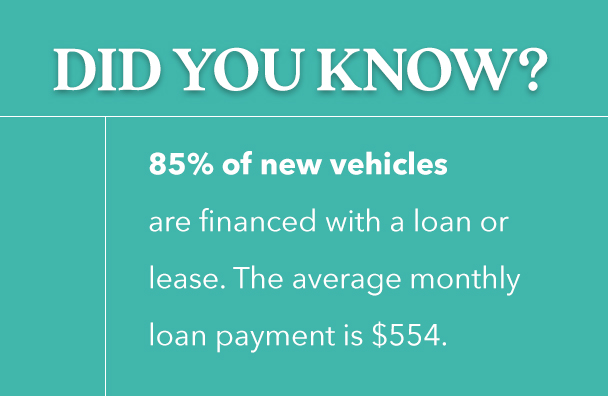

Source: Experian Automotive, Quarter 1 2019

Source: Experian Automotive, Quarter 1 2019The best way to finance a car is with 0% interest, right? But that $3,000 cash rebate offer is too good to pass up, isn’t it? Manufacturers may give you the choice between low interest terms and a hefty cash rebate, and the wrong choice could cost you during the life of your loan.

How to avoid: Use a car loan calculator to help determine which promotion will save you the most money in the long run. Enter the applicable numbers with 0% interest to estimate your monthly payment, then re-enter the same information using the rebate and the same loan length—and compare the two monthly payment estimates.