Is Now the Time To Refinance Your Car Loan?

Find out when to take advantage of refinancing to lower your monthly payments.

iStock

iStock

Interest rates are on the rise as the Federal Reserve works to combat inflation, which is currently at a 40-year high. If the rising cost of everything is wreaking havoc on your budget, one expense to reexamine is your car payment. Keep in mind, however, that rates on new car loans are up, too. As of the third quarter of 2022, the average new car monthly payment was $700. And at $525 a month, even the car payment for a used vehicle is high.

So what’s the best strategy for you? Here are some situations when refinancing makes sense, as well as some when it does not.

You forgot to shop around for the best rates.

Did the excitement of buying a new car leave you unaware of financing options beyond the dealership? By learning how to find and compare car loans through services like AAA Auto Loans, you could discover better financing deals than what your current lender offered.

Something better (like a lower interest rate) comes along.

Even if you did everything right when financing your car, auto loan rates offered by financial institutions are constantly fluctuating and you may find a more favorable deal.

Your credit score has improved.

Your credit score (which you can obtain by requesting a copy of your credit reports) is shaped by your credit history, the amount of credit card debt you hold and more. As such, your credit score has a big impact on the rate you get on an auto loan. An increase of a handful of points on your credit score can shave percentage points off the rate you would qualify for with a refinanced auto loan. Borrowers with good and excellent scores tend to get the best auto loan refinance deals.

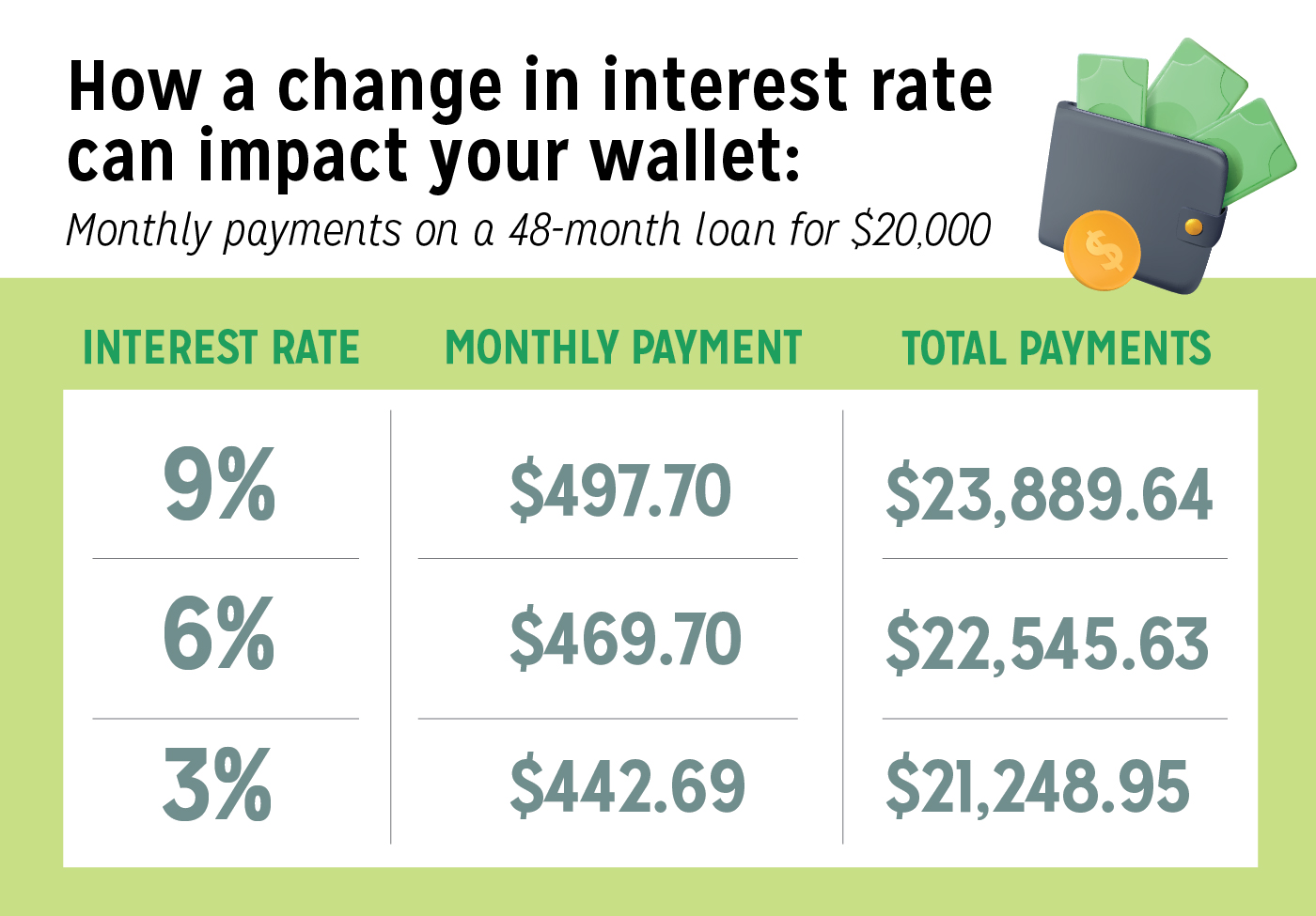

For example, here’s how a difference in interest rate impacts monthly payments on a 48-month loan for $20,000:

Refinance rates are not in your favor.

Compare today’s interest rates with the rate you got when you took out your car loan. If rates are higher than the rate you have on your car loan, it’s not a good time to refinance. In other words, you should stick with your lower rate.

You’re nearing the end of your loan term.

Refinancing can make the biggest impact the earlier it’s done in your original loan term. If done later, an improved rate may only alter your monthly payment by a few dollars—possibly not enough to offset any refinancing fees.

The loan term would be extended too long.

Just like when you’re buying a new car, don’t let the low monthly payments of a longer loan term tempt you. As your car depreciates, you may be stuck with negative equity well into the loan if you opt for a longer term with lower loan payments.

You’re upside down in your current auto loan.

If you owe more than the car is worth, refinancing your existing loan might not be an option. Getting a new loan while your car has negative equity requires excellent credit, and even then, some lenders won’t bite.