AAA: Auto Club Group Acts to Assist Hurricane Ian Victims

AAA member safety and protection, even in the aftermath of a hurricane.

Source: The Auto Club Group

Source: The Auto Club Group

AAA is passionate about member safety and protection, and that passion never wavers—even in the aftermath of a hurricane. As a Florida-based company, AAA - The Auto Club Group is acutely aware of Hurricane Ian’s impact on our fellow Floridians. Many of our employees across the state, and particularly along the Gulf Coast, also are cleaning up in the wake of this powerful storm.

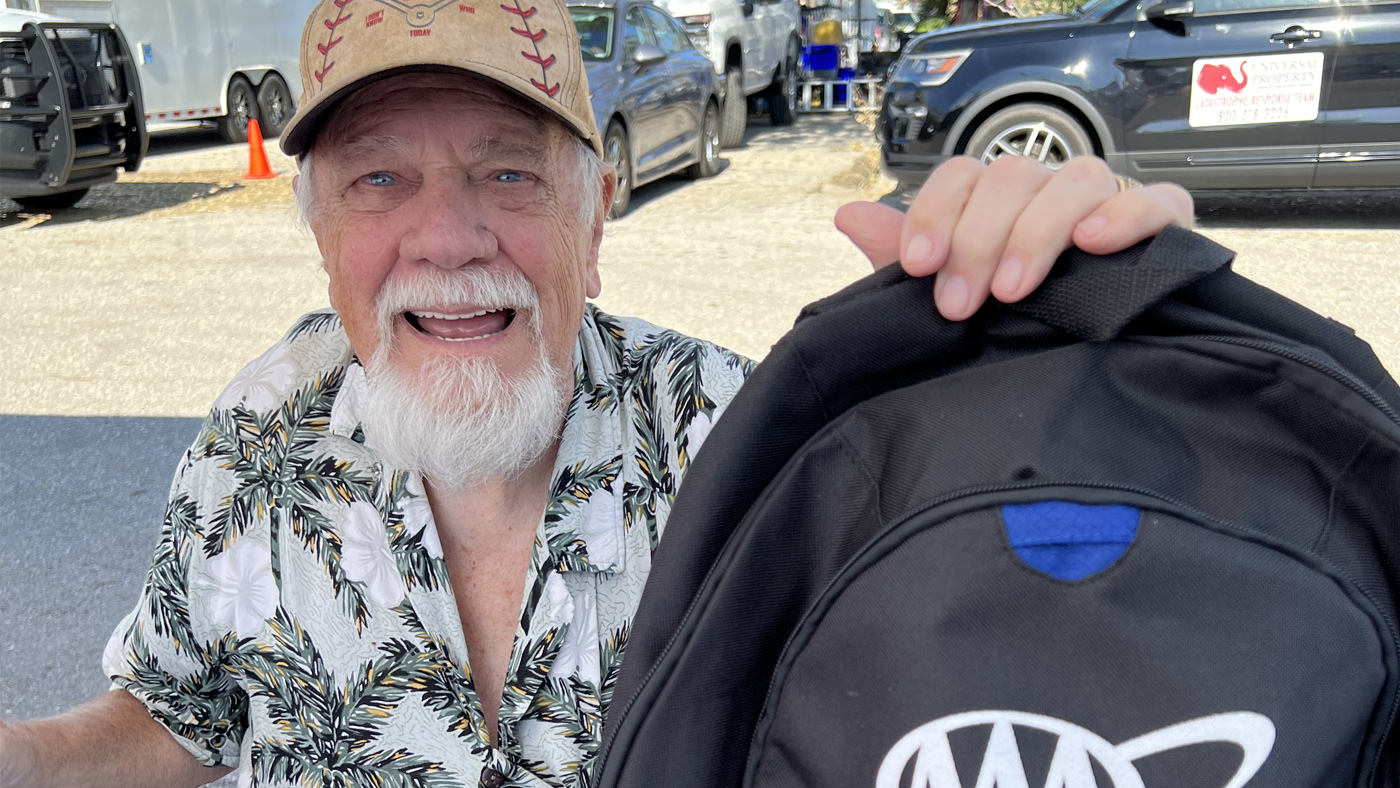

Recovering from this natural disaster will be a very long process and the needs will be substantial, so we are working with partners like the American Red Cross to help identify where our efforts will have the greatest impact. On an individual and more personal level, we have been distributing backpacks with much-needed items such as bottled water and mobile phone chargers for residents, as well as teddy bears and coloring books for kids.

Join Us In Support of Our Neighbors. Donate to the American Red Cross, and AAA will match all contributions (up to $25,000) made through this link.

Donate TodayThe AAA community comes together to support one another in times like these. An example of our commitment to one another is the recent activation of a fund specifically created to support AAA employees who are experiencing unexpected financial hardships in the aftermath of a catastrophic event such as Hurricane Ian.

Filing an Insurance Claim

If you have AAA Insurance and need to report a loss, please call our AAA Homeowner Claims line at 888-929-4222.

AAA Branch offices in the area are staffed to help with your claims.

Fort Myers

2516 Colonial Blvd, Ft. Myers, FL 33907

Port Charlotte

21229 Olean Blvd, Ste A., Port Charlotte, FL 33592

Please note, in some cases AAA will need to inspect the damaged property to confirm coverage for the loss and determine the amount of damage. While awaiting inspection, you should take steps to protect the property from further damage when necessary.

If temporary protection measures or repairs are needed, please make every attempt to photograph the damages prior to these temporary measures or repairs being completed. Permanent repairs should not be completed prior to inspection unless authorized by your AAA claims professional.

AAA has a dedicated Catastrophe Team made up of claims professionals who will assist you with documenting and evaluating your damages.

We realize that a sudden loss can be traumatic, even devastating. The Frequently Asked Questions (FAQ) below will help assist you through this process. This FAQ does not alter, delete or replace any of the terms or conditions of your policy.

Frequently Asked Questions:

What do I do after I receive the estimate from AAA?

- Review the estimate with your chosen contractor to ensure the full scope of the repair process is understood.

- If you would like to make any or all the repairs yourself, please contact us.

Whose responsibility is it to hire a contractor?

- As the property owner, it is your responsibility to select and hire a contractor. If you do not have a preferred contractor, your claims representative may be able to provide some names and contact information to assist you. Remember, the choice of contractors is always yours.

What if the contractor’s estimate is higher than AAA’s estimate?

- Contact the claims representative prior to any repair work beginning. They will review the differences in the estimate and, whenever possible, work to reach an agreement with your contractor.

What is “Replacement Cost”?

- It is the cost to repair or replace the damaged item(s) with an item or items of like kind and quality, without deduction for depreciation.

What is “Actual Cash Value”?

- It is the cost to replace an item with like kind and quality, less depreciation. Depreciation is a decrease in the value of an item due to its age and/or condition.

How will payment be made?

- If there is coverage for your loss, full reimbursement may be made in two or more payments. The first check will pay the Actual Cash Value of the damaged property, less any applicable deductible. You will receive a copy of the estimate, which details the Replacement Cost amount, depreciation and Actual Cash Value of the loss.

- If your policy has Replacement Cost Coverage, you can claim the depreciation amount when repairs are completed. To receive payment for depreciation, you need to submit an itemized invoice for the completed repairs. AAA will reimburse the depreciation that was withheld or the actual cost of repairs, less the initial payment and deductible, whichever is less.

Why is my mortgage holder included on the payment?

- Your insurance policy requires that the mortgage holder be included on the payment as payee. Because they hold the mortgage for your property, they do have a legal interest in what happens to it.

- You should contact your mortgage holder for information about endorsing the check and releasing funds to you for repairs.

What if I cannot live in my home until repairs are completed?

- Your policy may provide coverage for increased living expenses during repairs. Your claims representative can explain available coverage and can assist you in minimizing your loss.

Insurance Coverage for the Future

Get a free Homeowners Insurance Review. An agent will review your policy—from any company—so you know exactly what’s covered and which discounts you qualify for. Visit AAA Insurance to find an agent near you.

Beware of Fraud

Source: The Auto Club Group

Source: The Auto Club Group

The aftermath of a hurricane creates an opportunity for scammers and unlicensed contractors to take advantage of those who need help. AAA cautions residents about the potential of contractor fraud and offers these tips to help avoid it.

- Before hiring someone to make repairs, contact your insurance company to file your claim and ensure the damage is covered by your policy.

- Get itemized written estimates from at least three different licensed, insured contractors.

- Before you sign any paperwork and before a contractor starts work, allow your insurance company to come out and inspect the damage first.

- Work only with licensed and insured contractors, and check their credentials. Do not allow a contractor to inspect your property, including your roof, until you have verified that they are licensed and insured. You can verify that they have an active, valid Florida license at http://www.myfloridalicense.com/. Also, check for complaints filed against them on the Better Business Bureau’s website.

Visit the National Insurance Crime Bureau for additional tips and valuable resources to protect yourself from being victimized a second time by Hurricane Ian.

Dealing with Flood-Damaged Vehicles

Widespread flooding will likely result in significant damage to vehicles. Flooding is often covered by "comprehensive" auto insurance policies. However, because Floridians are not required to carry this coverage option, some may not be protected.

When a car has been partially or completely submerged, AAA recommends the following:

- Do not attempt to start a vehicle if the water level rose above the door opening and the interior of the car is wet. Doing so could cause major problems if flood water has contaminated the engine oil or other vehicle fluids.

- Take photos from the exterior of the vehicle. Do not open the doors if the water levels are still high.

- Once the waters have receded, take photos of the interior.

- Contact your insurance provider.

More questions, concerns or feedback?

Our claims representatives and leadership team are here to help you. Feel free to call regarding any issue that arises in the handling of your claim. AAA Homeowner Claims: 888-929-4222 / FAX: 630-328-7245 / Auto Club Insurance Company of Florida (ACICF)

Source: The Auto Club Group

Source: The Auto Club Group

Source: The Auto Club Group

Source: The Auto Club Group

Source: The Auto Club Group

Coverage is subject to all policy terms, conditions, exclusions and limitations. Discounts and savings opportunities subject to eligibility requirements. Subject to underwriting requirements. AAA Insurance is a collection of AAA branded insurance products, services, and programs made available to qualified members. Personal lines insurance is underwritten by Auto Club Insurance Association, MemberSelect Insurance Company, Auto Club Group Insurance Company, Auto Club Property-Casualty Insurance Company, Auto Club South Insurance Company, or Auto Club Insurance Company of Florida. ©2022 The Auto Club Group. All rights reserved.