Answers About Annuities

If you’re looking for a way to grow and protect your income, you may consider adding an annuity to your financial portfolio.

iStock

iStock

An annuity is an insurance product offered by an insurance company or other financial institution as an investment tool that pays out a fixed amount of money over a certain term. Deciding on the type of annuity, investment amount and the best time to add it to your portfolio mix can be a complex formula to work out.

Luckily, Ryan Huber, Agent Development Specialist with the Life & Annuity team for AAA, is here to help. AAA Living chatted with Ryan to get answers to your questions about annuities.

Q: What are the most common types of annuities?

Annuities fall into two broad categories: fixed and variable.

- Fixed annuities provide a guaranteed return and don’t correlate with the stock market. This means that if a company guarantees a specific return, you’ll get that return or more on your money. There’s no risk with a fixed annuity.

- Variable annuities are the opposite in that the interest rate fluctuates and they correlate with the stock market. With a variable annuity, you may enjoy higher interest rates, or you may see lower interest rates, depending on how the market is performing. Because there is risk associated with variable annuities, there is the potential to lose money.

Q: That doesn’t seem so complex. Is there more to it?

Yes. Within these broad categories of fixed and variable, there are many kinds of annuities. The one you select is based on a list of options, such as length of term, premium requirements, investment strategy, interest rate and more.

Q: How do annuities work?

An annuity is an investment account that houses your money. An individual contributes to the annuity either with a lump sum or through a series of payments. The money is invested by the annuity provider (like AAA Life) and grows over time by earning interest.

Q: Why do people use annuities?

Annuities provide income. People who want to ensure they have cash flow during retirement may use an annuity to guarantee a set amount of money each month. Annuities can also pass along to designated beneficiaries that typically go directly from the insurance company to the beneficiaries, avoiding the probate process.

Q: What are the minimum and maximum amounts you can contribute?

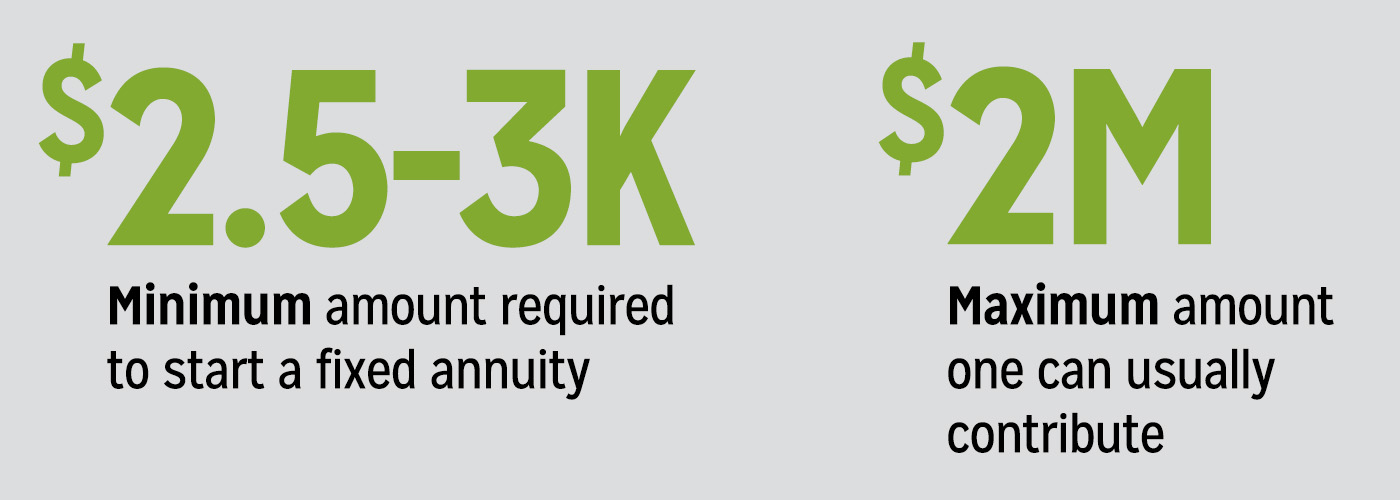

AAA Life Insurance Company requires $3,000 to start a fixed annuity, but there are some annuity providers that will start as low as $2,500. The maximum is usually $2 million. However, if an investor wants to go above $2 million, additional approval and documentation are required.

Q: Why do people get confused about annuities?

Two reasons. First, there’s an abundance of choice. There are many different kinds of annuities, so understanding the details and differences of the various products can be confusing.

For example, AAA offers three annuity products, and understanding which one is right means that investors have to do their homework. Working with a qualified agent can really help streamline the process because you’ll be able to lean on someone who’s educated about this complex subject. An agent can also help explain the jargon and answer your questions.

Second, there’s a general lack of education about what annuities are. Annuities haven’t enjoyed the same kind of PR and marketing as other investment options, like a 401(k) account or life insurance. In fact, people often confuse annuities with life insurance.

Q: On that note, what’s the difference between an annuity and a life insurance policy?

Typically, an individual purchases a life insurance policy to provide a tax-free lump sum benefit for a beneficiary upon the policyholder’s death. An annuity can provide income to the investor during their lifetime, typically to help with retirement.

They can also provide a legacy to loved ones when the proceeds of the annuity aren’t used for income.

Dig into the differences between life insurance and an annuity.

Read More >>Q: Do you need to be retirement age to purchase an annuity?

No, you can be any age. Selecting an annuity is often based on your financial situation and investment goals. If you’re looking for a safe, steady growth investment, then a fixed annuity can be smart. If you have a higher risk tolerance, then a variable annuity could be the way to go.

Q: Is the money in an annuity liquid?

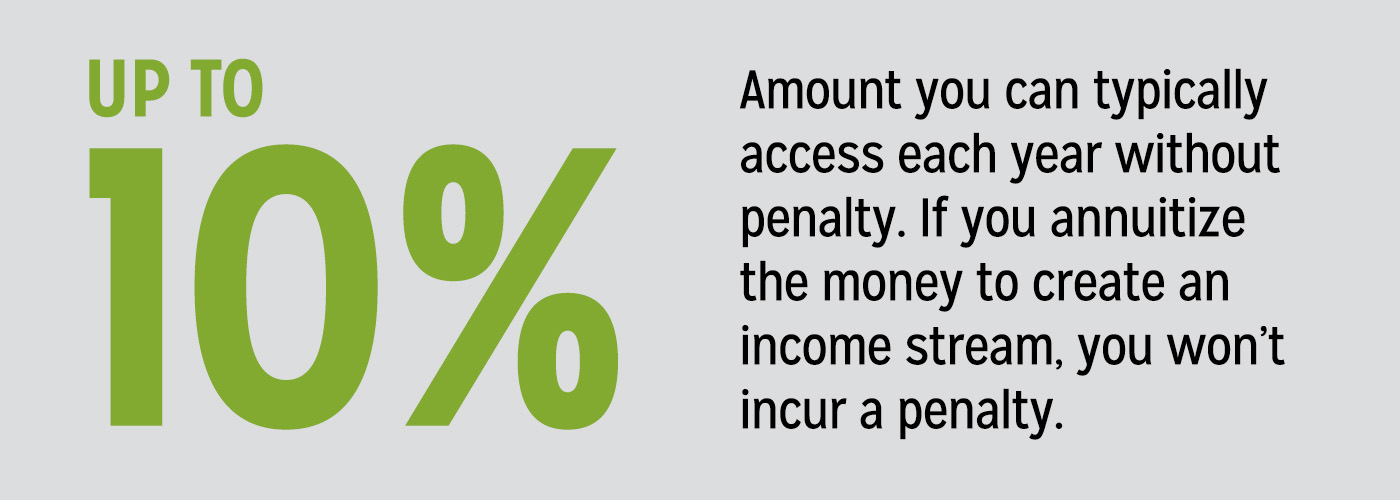

Typically, you can access up to 10% of the amount each year without penalty. Also, if you annuitize the money (aka create an income stream), you won’t incur a penalty.

Both qualified and non-qualified annuities require you to be age 59.5 before withdrawing funds. If you withdraw the money before that, the IRS imposes a 10% tax penalty on earnings.

Knowledge is power. AAA can help you find the right annuity.

Learn More >>Q: Can I have more than one annuity?

Yes. If diversification is part of your investment strategy (and it should be!), then you may want to consider different types of annuities.

Q: I’ve heard portfolio diversification is important, but how does an annuity fit into the strategy?

Think of a fixed annuity as the foundation of the portfolio because it’s safe and secure. Once the foundation is solid, you build it up with different investments that have different risk tolerances. That’s when the variable annuity might come into play.

Q: How do I know which type of annuity to choose?

The options available for investment are diverse so I recommend sitting down with an annuities or financial services agent to evaluate what makes sense and to make sure your goals are aligned with your investment strategy. An agent can help you figure out what makes sense by conducting some type of financial or needs analysis. AAA Members—and even non-Members—can talk with an agent at 855.880.5750.

Life insurance underwritten and annuities offered by our affiliate AAA Life Insurance Company, Livonia, MI. AAA Life (CA Certificate of Authority #07861) is licensed in all states except NY. Products and their features may not be available in all states.