Specialty Insurance: FAQs for Boats, RVs and Motorcycles

Coverage for the vehicles you play in is as unique as the toys themselves.

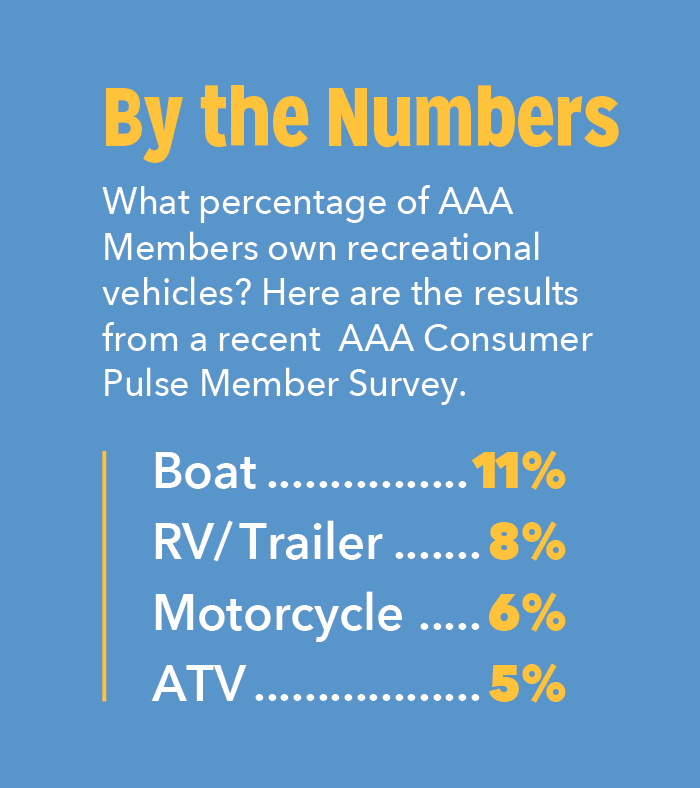

There’s something special about going for a ride on your motorcycle, boat or all-terrain vehicle on a warm, sunny day. These and other leisure vehicles offer an experience you can’t get in your everyday car, truck or SUV. In the same way, the insurance for these vehicles, called specialty line insurance, is different from ordinary insurance.

“The most important part,” says Katie Nicholas, product manager for Auto Club Group Insurance, "is understanding that specialty line insurance helps to cover the unique exposures associated with the product.”

Not everyone immediately thinks about the need for insuring these secondary vehicles, which is understandable because not every state requires off-road enthusiasts to cover them. But in addition to being a smart play from a liability perspective, maintaining proper coverage can have the added benefit of generating a multivehicle or policy discount. You’ll likely qualify for lower premiums if you bundle your insurance policies with a single company.

Breaking it down

AAA’s Katie Nicholas answers a few FAQs:

What are some examples of vehicles that can be protected with specialty line insurance?

This insurance may refer to coverage for a range of items, such as motorcycles, campers, motor homes, golf carts, all-terrain vehicles, boats and personal watercraft.

Is this kind of coverage an extension of an existing policy, or is it a separate one?

Coverage is not normally extended through a standard auto or homeowners policy. A specialty line policy may include more than just coverage for physical damage and liability exposures.

For example, a boat policy may extend coverage to some equipment and attached accessories. It may also be tailored to the size of the boat, how it is used and where it is stored. Settlement options may also need to be considered, such as with classic or vintage cars, motorcycles, or boats where the value may be considerably higher.

What about the contents of a boat or RV? Are items such as pricey fishing gear or electronics in a luxury motor home covered too?

This is another point to discuss with your insurance agent. For example, a few inexpensive fishing poles may not require special coverage. However, a line of high-end equipment may be best scheduled on a personal articles policy under homeowners insurance or through an endorsement on your boat policy, extending additional coverage.

How can you be sure that specialty line insurance is in sync with your other policies?

As a best practice, contact your local AAA Insurance agent for a personal household coverage review and to ask questions about your coverage, no matter what company is insuring you.