5 Ways To Help Prevent Credit Card Fraud

Protect your digits from identity theft this holiday season—and all year round.

iStock

iStock

Credit card fraud is an unfortunate reality of commerce—one that’s exacerbated by the growing number of channels in which scammers can access information. No longer just

relegated to trying to get at your info via phone and snail mail, fraudsters are now using text, email, apps and even social media for their trickery.

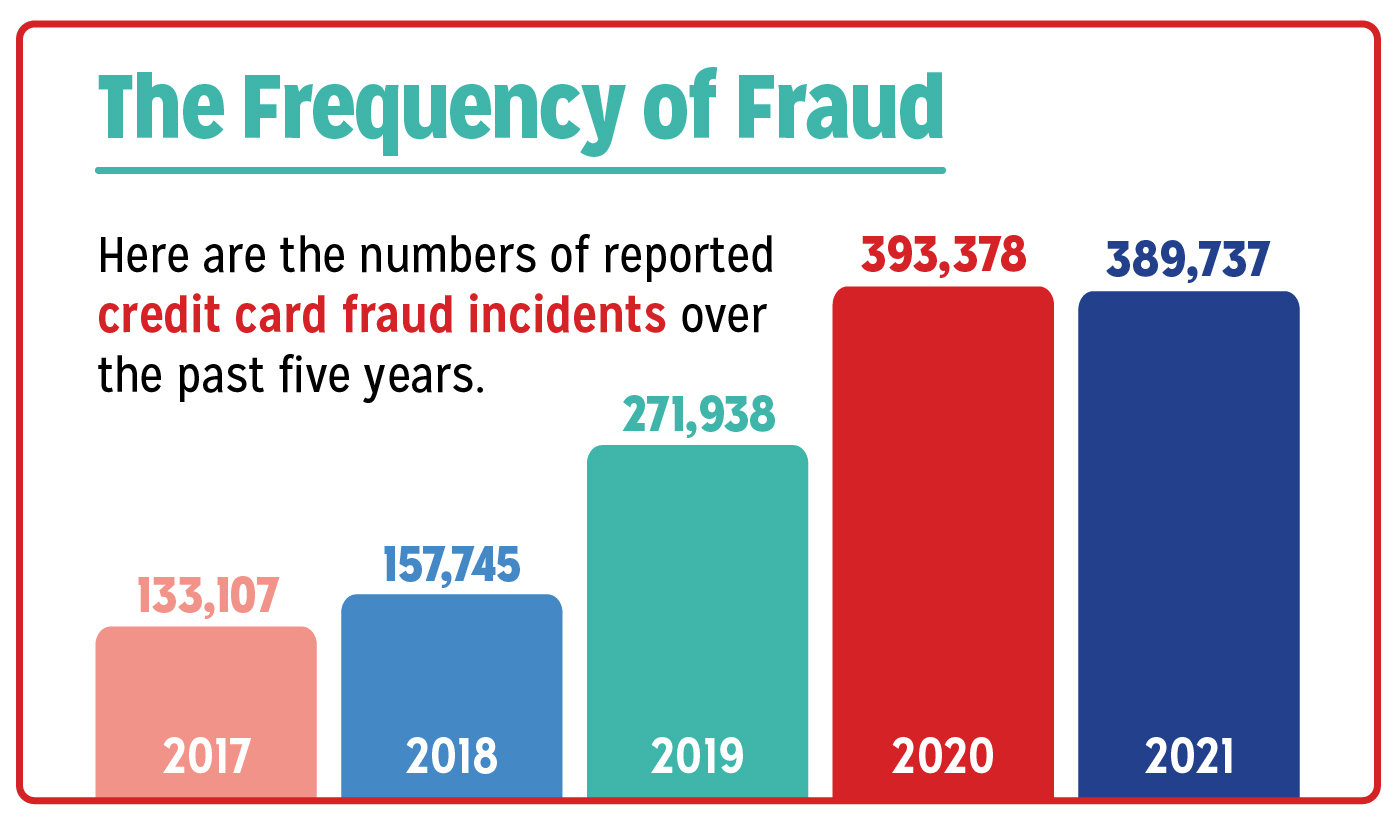

And from the numbers reported by the Federal Trade Commission’s annual report, “Consumer Sentinel Network Data Book,” they’re quite adept at it. The 2020 report shows that credit card losses totaled approximately $149 million that year. Just one year later, that figure jumped to $181 million.

While swindlers and scammers are savvy, you can often outsmart them with a few easy-to-follow practices. Whether you do your holiday shopping online, in a store or with an app, keep these four tips in mind to help prevent credit card fraud and identity theft.

Keep track of activity.

Review your credit card and bank statements to make sure you recognize the transactions.

Turn on alerts from your bank or credit card issuer so you’ll know when spending is taking place on your account.

If you see that something is incorrect, call the credit card company or bank immediately.

Beware of phishing.

Phishers try to trick consumers into revealing personal information and sometimes try to gain trust by using familiar logos and company names in emails, texts and even snail mail. But if you look closely, you’ll see the sender name may be misspelled or a logo may be altered. If you suspect an email or communication is from a phisher, don’t click or download it.

Use a digital or mobile wallet.

Mobile wallets (a form of digital wallet) make paying at stores safer because they feature technology that changes payment information with every transaction. These apps can store your credit card or banking information—as well as store rewards, tickets, coupons and more.

With a mobile wallet, a merchant never collects your actual card number, which helps prevent credit card fraud. Examples of mobile wallet apps include Apple Pay, Venmo and Google Pay.

Consumer Sentinel Network Data Book 2021

Consumer Sentinel Network Data Book 2021

Be secretive.

Never provide your credit card information over the phone, on social media or on public Wi-Fi. The same goes for banking information and your Social Security number.

Report lost or stolen cards immediately.

The sooner you report a missing or compromised credit, bank or retail card, the faster you can stop thieves from racking up purchases.

Quick action can also mean you’ll have less liability for fraudulent charges.