6 Ways Recent College Grads Can Build Their Wealth

The sooner you develop good money habits, the better off you’ll be down the road.

All images: iStock

Post-college life can cost you. For instance, the average federal student loan debt balance is $37,014, according to the Education Data Initiative; the average price of a new car is over $47,000, says Consumer Reports; and, according to the Federal Reserve, the average retirement savings of American families is $255,200.

If you’re a recent graduate who wants to pay off a student loan, save enough money to buy a car or grow savings for early retirement, now’s the time to start building your wealth. To do it, take these concrete steps:

Start a monthly budget

The first step to managing your finances is to track your monthly income, expenses and debt. (If you lack steady income, try to calculate the average you earn each month.) Next, identify your expenses, making sure to include the fixed and variable kinds. And consider following the 50/30/20 rule with your monthly budget: Use 50% of your take-home income for needs, 30% for wants and 20% for savings and debt repayment. Money-tracking apps like Goodbudget or Mint can help manage all this.

Get more money-saving tips here.

Set up automatic savings

The sooner you start saving, the easier it will be to hit your goal. Review your budget to determine how much you can save each month, and make your savings stick by setting up recurring automatic deposits to your savings account. Continue to review what you’re able to save, increasing the amount you put aside whenever possible. If your employer matches 401(k) contributions, make a point of maxing out what they’ll contribute—that’s free money.

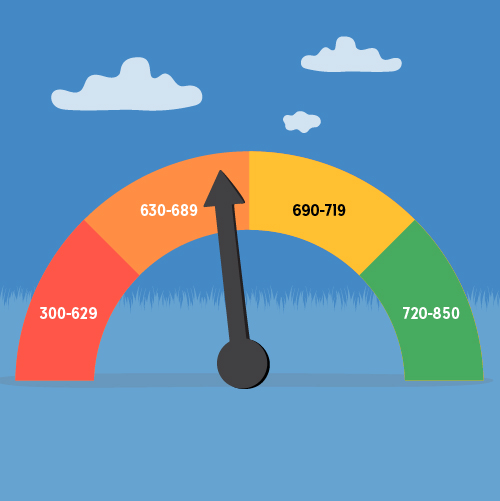

Work on building your credit score

Your credit score, a number between 300 and 850, reflects your credit history—a record of how dependable you are when it comes to paying debts. This score indicates your risk level to lenders as they determine whether they will offer you a mortgage, credit card or some other line of credit. It can also affect the interest rate they charge you.

The most widely used credit scoring model was created by the Fair Isaac Corporation, also known as FICO. Your FICO score is calculated based on five factors.

- Payment history accounts for 35% of your score (which is why it’s so important to make on-time payments).

- Credit utilization (how much of your available credit you’re using) accounts for 30% of your score.

- Length of credit history (a record of your ability to repay debts) accounts for 15% of your score.

- Types of credit (your combination of installment credit—such as car loans or mortgage loans—and revolving credit, such as credit cards) accounts for 10% of your score.

- Credit inquiries—made by potential lenders after you apply for a loan or credit card—account for 10% of your score and affect it for 12 months.

Don’t let identity theft hurt your good credit. AAA Members get free credit monitoring, lost wallet protection and more with ProtectMyID Essential. Learn more here.

Open a line of credit

Building solid credit is important for new grads. Once you prove you qualify, you can apply for a credit card. After you get one, you’ll need to maintain smart practices, including paying bills on time and keeping credit card spending at or below 30% of your limit. If you make a large purchase on credit, pay it off in time to avoid interest charges, which will eat into your monthly income.

Find out how to earn cash back on qualifying net purchases with the AAA Cashback Visa Signature® Card here.

Explore investing options

Investing will help build your wealth, and you don’t have to be rich to do it. There are options available for everyone, even if you’re a beginner with just a small amount of money to put to work. AAA Banking can help you get more from every dollar with great rates on financing and accounts that earn you interest. Experts will work with you to make informed decisions that meet your risk tolerance, time horizon and personal needs.

Explore investing options with AAA Banking here.

Consider life insurance

Some permanent life insurance options build cash value that can be used to help with purchases if needed. The policies accumulate value as you pay premiums, similar to how you build home equity as you pay your mortgage: You can borrow from your policy to help pay for a child’s college tuition, take out a loan for home improvements, or withdraw money to help supplement your retirement income.

You may feel like you don’t need life insurance when you’re young and healthy. Really, though, that’s the best time to buy it and get the lowest premiums.

Learn more about getting life insurance when you’re young.