Outsmart Inflation and Keep Retirement Golden

Make your money work smarter, even when inflation is sky high.

iStock

iStock

Inflation is happening around the globe, driving up the costs of goods and services. As a result, those things you want or need to buy—groceries, clothes, vacation—cost more today than they did before.

In other words, your dollars don’t go as far anymore, and now you have less purchasing power.

While cutting back on discretionary spending is a highly recommended strategy, you can also win by flipping the perspective—and making the money you do have work smarter.

What’s going on with the economy?

Inflation is a moving target that can be measured annually. The long-term average for inflation is around 2%, which means the dollar is holding its value in comparison to the cost of goods and services. This makes the Federal Reserve happy because the amount consumers are paying aligns with the value of the things they’re purchasing. So, everything is even-steven.

For example, at the end of 2020, the year-over-year inflation rate was 1.4%. As of July 2022, it jumped to a high 9.1%. However, this doesn’t necessarily mean the prices of the things you buy regularly—groceries, gas, etc.—were up by only 9.1%. In fact, the Consumer Price Index revealed that there’s been a 12.2% increase in grocery prices. So that gallon of milk, carton of eggs or pack of soft drinks likely costs 12 cents more per dollar.

Increase savings by using what you have.

You can’t do anything about the inflation rate, but you can control how you react to it. One way to stretch your money during retirement is to create additional income with your savings. Here are four ideas:

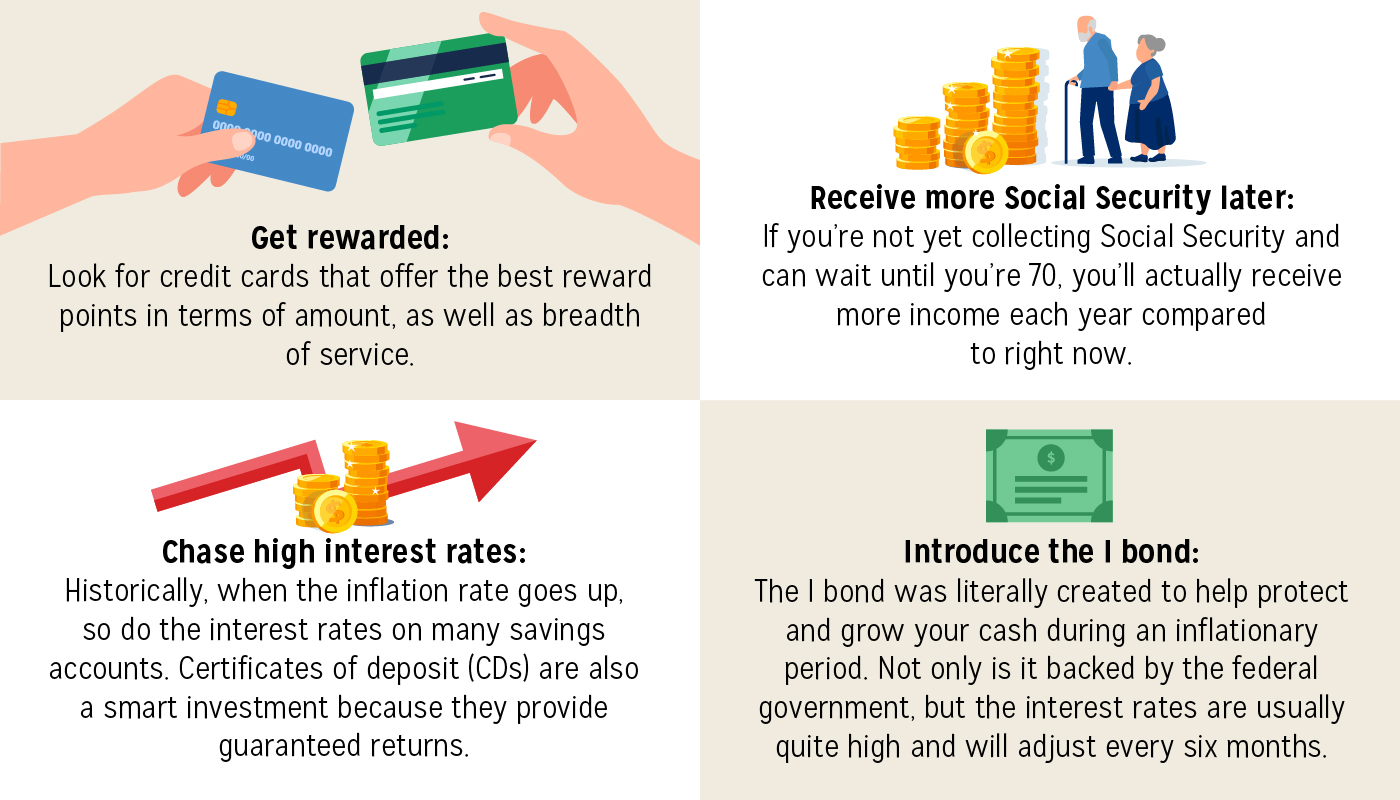

Get rewarded: Earning rewards points on credit card purchases isn’t new, but the competition for your business has heated up. Way up. Look for credit cards that offer the best rewards points in terms of amount, as well as breadth of service.

Chase high interest rates: Historically, when the inflation rate goes up, so do the interest rates on many savings accounts. Certificates of deposit (CDs) are also a smart investment because they provide guaranteed returns. The longer the term of a CD, the higher the interest rate—and the more money you can make.

If you see a rate difference between various savings accounts or CDs, consider moving your money. Depending on the amount you’ve saved, even a half of a percentage point could be significant.

Receive more Social Security later: If you’re not yet collecting Social Security and can wait until you’re 70, you’ll actually receive more income each year compared to right now.

Introduce the I bond: The I bond was literally created to help protect and grow your cash during an inflationary period. Not only is it backed by the federal government, but the interest rate is usually quite high—as of August 2022, it’s nearly 10%—and will adjust every six months. You can invest a little or up to $10,000.

Please note: This investment option offers a 30-year maturity, but you’re able to redeem the bond in the short term to assist with retirement income. If you if redeem within the first five years, you lose the last three months of interest. For example, if you pull out your money after one year, you keep the interest on nine months but forfeit the interest you earned for months 10, 11 and 12.

Consolidate debt to save.

Another way to increase your available income is by funneling your debt into one place. Why? Because if you hold multiple credit cards or lines of credit, then it’s likely you pay various interest rates. Why not put all your debt into the credit option with the lowest rate?

When you consolidate all the available debt into one single credit option, you’ll get one rate and have one payment, which can help you pay the debt off faster. The quicker that debt is gone, the more income you’ll free up. And faster payments are also likely to boost your credit score, which will then help you get lower interest rates the next time you need credit or a loan.

Discover discounts.

Some of your favorite brands have set up programs that honor retirees, offering a variety of discounts that’ll make every dollar go further.

Flaunt your age: Many retail and dining establishments offer senior discounts, including fast food and dine-in restaurants; movies and entertainment activities; grocery chains; as well as popular hotel brands.

Deals of the week: When it comes to saving money, who doesn’t like to shake things up? AAA Members can save on deals that change every week.

Offers via extension: Take a few seconds to download the AAA Discounts web extension, and you’ll have the opportunity to save whenever you shop and search online and visit partner websites. Once you download the extension, there’s nothing more to do. You’re ready to start saving on the items you’d buy anyway.

By following these tips, you’ll be able to maximize your purchasing power—and maybe find a way to splurge on a few extras, too.