Money Tips for Newly Engaged Couples

It’s a major life step—let AAA make it easier.

iStock

iStock

First off, congrats! Getting engaged is an exciting and, needless to say, major milestone. But at times it can be an overwhelming one, too. So, now what? The next steps usually consist of telling friends and family, throwing an engagement party, buying a dress, planning the wedding… Oh, right, the wedding.

Between picking out flowers and drafting the seating chart, you and your soon-to-be spouse may not be thinking about all of the important details in between. But with AAA, you have help crossing the less exciting things off your list while you’re riding high on the journey to the next chapter of your life.

Here are five ways AAA can help when you’re newly engaged:

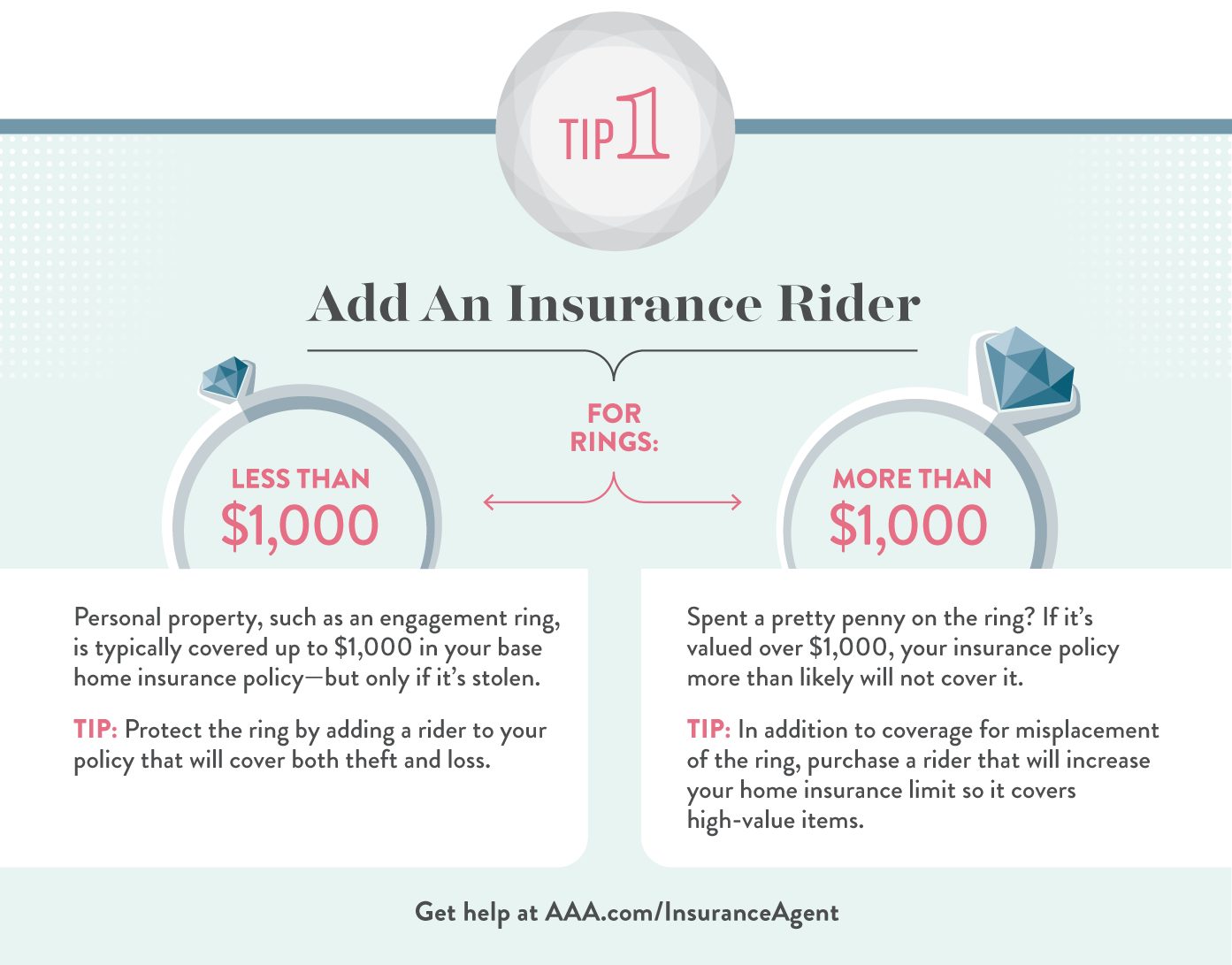

1. Engagement ring insurance

The average cost of an engagement ring was $5,000 in 2016. That’s a hefty price tag—and for such a significant item, you’ll want to make sure it’s protected. To do so, look into adding a rider—sometimes referred to as an endorsement—to your existing homeowner’s or renter’s insurance policy.

The additional cost for riders varies based on the ring’s value, your policy’s deductible and even the crime rate in your neighborhood. But for the added peace of mind, the extra cost is worth it, so you and your fiancé can continue the engagement celebrations without worry.

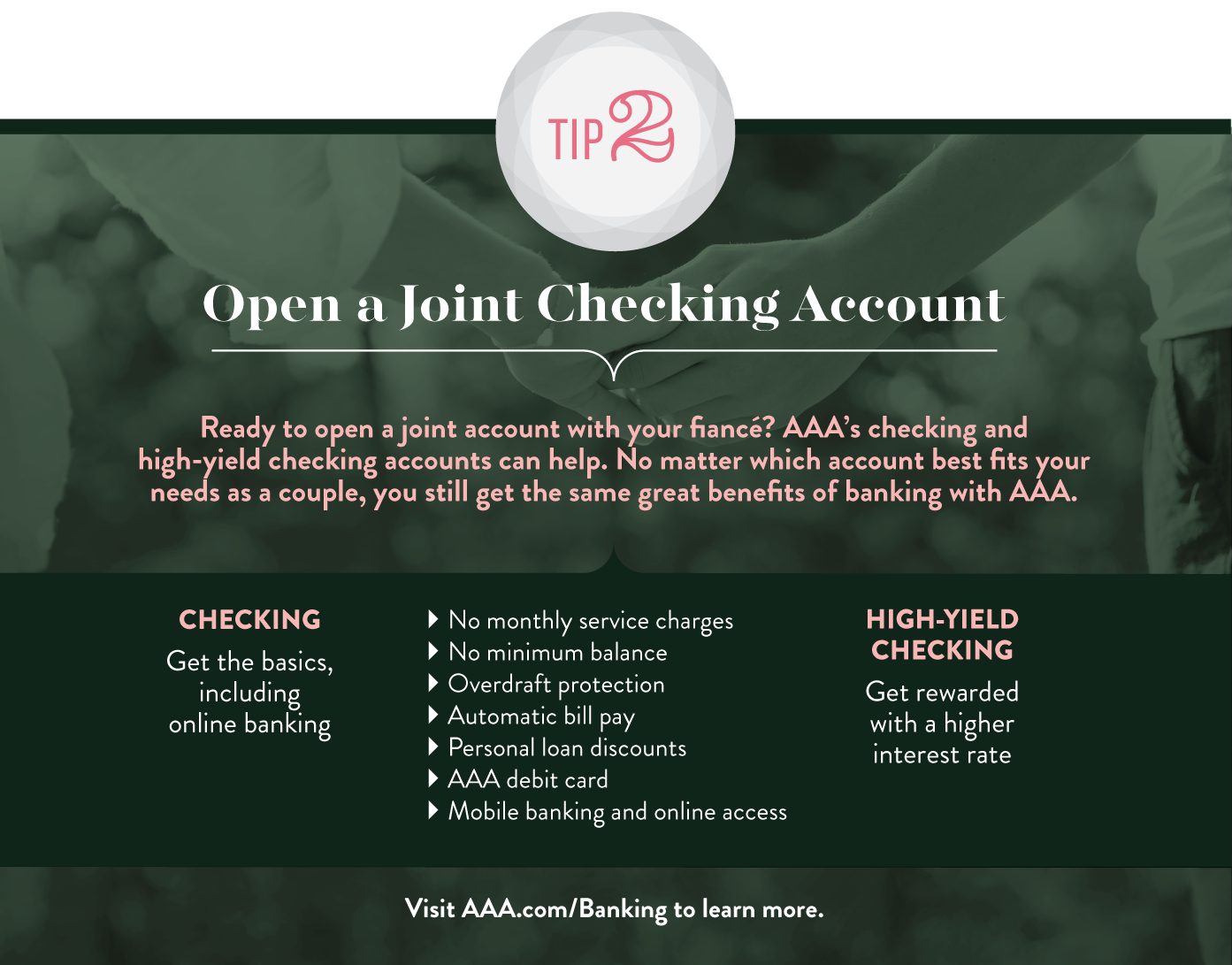

2. Options for combining finances

Money is a frequent stressor in a relationship. So, if you’re newly engaged and want to start combining your finances with your significant other’s, consider a checking account for wedding expenses. Joint checking accounts help promote communication and trust.

Oh, no AAA Membership required either—and AAA also offers savings accounts, CDs, IRAs and more.

3. Honeymoon travel

After all the stress of planning a wedding, the honeymoon can be a light at the end of the tunnel. You can book the entire trip through a AAA Travel Advisor—even cruises and car rentals. Your local advisor can help you make sense of discounts and savings, as well as guide you to exclusive AAA offers. There are many inspiring destinations to choose from.

The perks don’t stop there. AAA also offers TripTik Maps to help you find the best route to your destination and TourBook guides to help you find the best places to go once you get there.

4. Wedding party discounts

Your wedding party has been there since the beginning—from the first date to the wedding vows. So, of course, you want to make sure they feel appreciated for being a part of the big day. With your AAA Membership, the discount and reward perks can help show your gratitude.

Did you know you could earn 2 percent in AAA Dollars when you purchase gift cards online? You can personalize each one with a free digital greeting, too.

5. Home-buying help

First comes love, then comes marriage. Then comes, well, probably purchasing a home—and that process can be a confusing one. But with AAA, you have access to home loan experts who can help guide you through the entire process.

From searching for a home to signing the papers, AAA makes the convoluted process of finding and purchasing a home a simpler one.

And when you and your fiancé do become homeowners, AAA can help offer peace of mind with home insurance.