4 Steps To Creating a Monthly Budget You Can Actually Stick To

Take control of your monthly spending.

iStock

iStock

Money management can be one of the biggest sources of anxiety for many U.S. adults, with 57% feeling stress about not having enough to pay for things in the present—and 43% feeling stress about saving enough for the future.

While most people have a desire to take control of their finances, they need a place to start. Here are four tips that can help you create a monthly budget—and stick to it for the long term.

1. Establish your income.

Before you can create a monthly budget planner, you need to know your financial baseline. Take stock of the pay you actually receive—subtracting 401(k) contributions, health insurance premiums, taxes and any other payroll deductions.

If you’re paid a salary, your take-home income is easy to track. However, if your pay depends on unpredictable variables like hourly wages or commission, look at past pay statements and determine a reasonable average monthly income. Err on the side of expecting lower paychecks and take unusually high amounts out of the equation.

2. Make a plan.

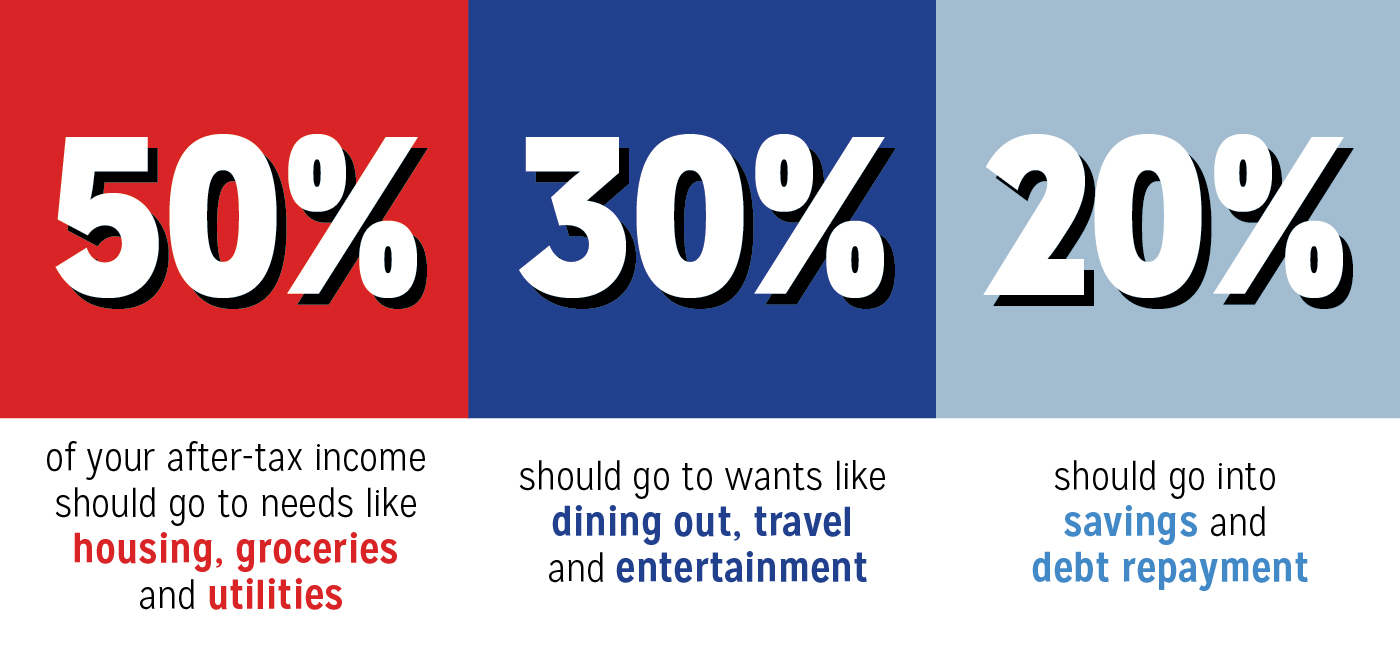

Most spending can fall into three buckets:

- Needs

- Wants

- Savings and debt repayment

While there are many schools of thought on how to budget, one of the most popular—and simple—is the 50/30/20 budget. Here’s how it works:

If you need to tweak how you break up your spending, take from wants first, so that your needs and savings or debt repayment don’t suffer.

Raising your credit score can save you serious money on interest rates. Learn how to boost your number.

Read MoreIf you’re having trouble creating a monthly budget that fits your income, there may be ways to save on your expenses. Shop around to see if there are better rates for things like auto insurance or cellphone service. Or you may need to stop eating out and cook at home more. And here’s a tip: AAA Members can also take advantage of exclusive discounts on things they use every day.

3. Track your spending.

The most difficult part of any monthly budget is sticking to it, and bad spending habits can be hard to break. Persistence and discipline are key, especially when you’re first starting out.

Popular free apps like Mint and PocketGuard can help you track what you’ve spent so you can stay in control. (Here’s a list of other well-ranked budget apps.)

4. Refine and adapt your process.

Perhaps your grocery bills are lower than you expected. Or you’re driving more than you thought you would (and gas prices are so high). Maybe you got a nice raise at work. Whatever the reason, it’s likely your budgeting needs will fluctuate over time.

Revisit your budget when your income or regular expenses change to ensure that you’re allocating the right amount in the right places. Make adjustments with your financial goals in

mind—and avoid making your budget what you wish it could be rather than what it needs to be.