Sidestep 5 Types of Fraud in the New Year

These tips can help safeguard your identity and help you avoid fraud related to taxes, credit cards, bank accounts, mail and insurance coverage.

iStock

iStock

How many times a day do you avoid calls from unknown numbers? Do you receive texts saying you’ve won a prize? Is your inbox filled with emails about mysterious bills or offers?

These are all likely instances of fraud—and you’re not alone in being targeted. Data from the Federal Trade Commission shows that consumers reported losing more than $5.8 billion to fraud in 2021, an increase of more than 70% over the previous year.

Identity theft and imposter scams were the most common types of fraud reported in 2021. And one way fraudsters reach their victims is through a tactic known as phishing. Phishing occurs via a fraudulent email, phone call or text message that may start with a generic, impersonal greeting and sometimes includes an urgent plea to take fast action.

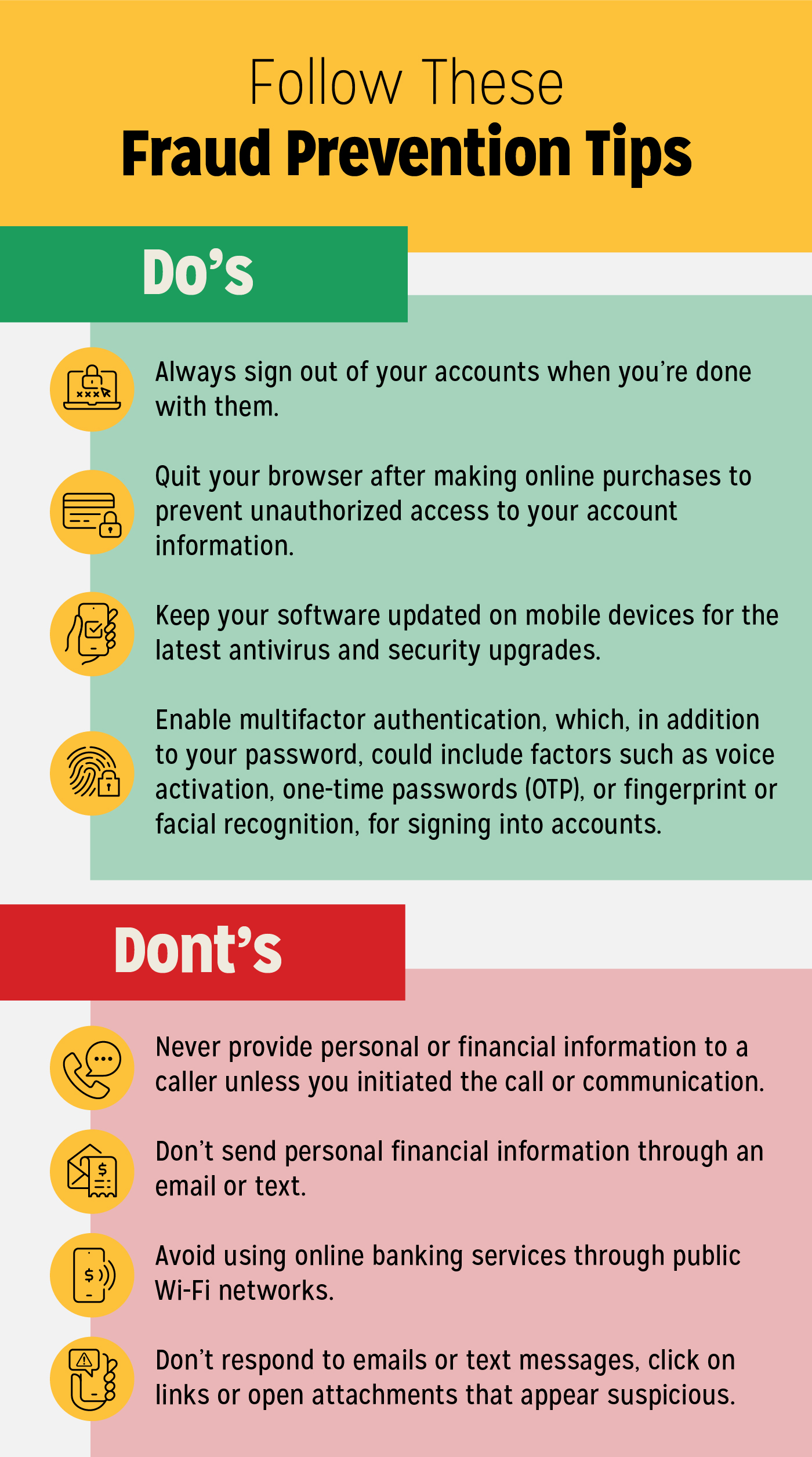

But bogus emails or texts aren’t the only ways that fraudsters trick their victims. There are multiple methods they can use to access your data, which is why taking measures toward fraud prevention to protect your tax and insurance information, credit cards, bank accounts and mail is critical to keeping thieves at bay.

iStock

iStock

Beware of tax fraud.

With tax season approaching, it’s smart to be on high alert to the ways your financial data can be compromised. Oftentimes, taxpayers aren’t aware that their information was compromised until it’s too late.

One tactic you can use to reduce the odds of tax identity theft is to file your tax return as early as possible. Doing so shortens the window of opportunity in which a criminal can submit a return in your name. Also, it’s smart to familiarize yourself with common tax scams—including things like a bogus call from the IRS—and take quick action if you find out you’ve been victimized. (And if you’re mailing your return, follow these tips from the U.S. Postal Service for how to do so securely.) for how to do so securely.)

Some scammers may try to alarm taxpayers by using a variety of scare tactics. But remember, the IRS will never:

- Initiate contact with taxpayers by email, text or social media to request personal or financial information.

- Call to demand immediate payment.

- Request Identity Protection PINS by phone, email or text.

- Call with threats of lawsuits or arrests.

Tip: The Taxpayer Guide to Identity Theft offers advice on fraud prevention and assistance if your identity has been compromised.

Learn How To Report Suspected Tax Fraud Activity to the IRS

Read More >> iStock

iStock

Implement better banking habits.

Protecting your bank accounts and other financial accounts starts with regular account monitoring. Experts recommend setting up alerts to notify you when purchases or withdrawals are made so you can verify their validity. Here are nine additional tips designed to keep your accounts safer.

- Create unique usernames and long, complex passwords that include a mix of letters, numbers and special characters for accounts.

- Consider a password manager, like Norton Lifelock, to help generate and manage your passwords.

- Enable multifactor authentication, which, in addition to your password, could include factors such as voice activation, one-time passwords (OTPs), or fingerprint or facial recognition, for signing in to accounts.

- Establish out-of-wallet questions or personal knowledge-based authentication (such as your mother’s maiden name or your high school mascot) to verify access.

- Consider a digital wallet for purchases so that a unique digital number (also called a token) is used for transactions. Businesses and sellers won’t see your credit or debit card number.

- Always sign out of your accounts when you’re done with them. Quit your browser after making online purchases to prevent unauthorized access to your account information.

- Avoid using online banking services through public Wi-Fi networks.

- Keep your software updated on computers and mobile devices to ensure the latest antivirus and security upgrades are installed.

- If your phone is lost or stolen, contact your mobile service provider immediately to determine if your service should be shut off.

iStock

iStock

Prevent credit card fraud.

Almost half of American adults have experienced credit card fraud, but only about 60% of cardholders have enabled text or email alerts to notify them when account activity is taking place, which can help alert them to any suspicious activity right away. Being proactive in protecting your accounts can go a long way toward keeping your digits safe.

Here are some additional tips on fraud prevention:

- Sign the back of your credit cards immediately.

- Memorize your PIN.

- Never send your credit card number by email or text.

- Shred preapproved credit card applications before throwing them away.

- Opt out of getting credit card offers in the mail by calling 1-888-567-8688 or signing up here.

Get more tips on preventing credit card theft from TaxAct. AAA Members can also save 25% on federal and state filings.

Get Information >>Protect your mail.

Help ensure that your mail stays secure with Informed Delivery® through the U.S. Postal Service. The free service allows you to track packages and preview your mail before it arrives. Learn about the benefits and how it works here.

There are several ways to secure your mail.

Start Now >> iStock

iStock

Avoid insurance fraud.

Insurance fraud occurs when an insurance company, agent, adjuster or consumer is deliberately deceptive in order to achieve an illegitimate financial gain. One common form of fraud is exaggerating a claim.

Insurance fraud can happen with any type of coverage: health, life, property and casualty, and workers’ compensation.

The National Association of Insurance Commissioners (NAIC) recommends consumers confirm that the insurance company they’re about to deal with is a lawful business. Verification can include contacting the state’s insurance department to make sure the company is real and is approved to sell insurance in the state in question.

Tip: For guidance on how to identify and address insurance fraud, start with the NAIC’s Center for Insurance Policy and Research.

Can you spot auto insurance fraud?

Learn How >>