The FIRE Movement—A Balanced Look at Financial Independence and Early Retirement

This alternative way to achieve financial independence and early retirement has grown in popularity in recent years, but it’s not a decision to make lightly.

Getty

Getty

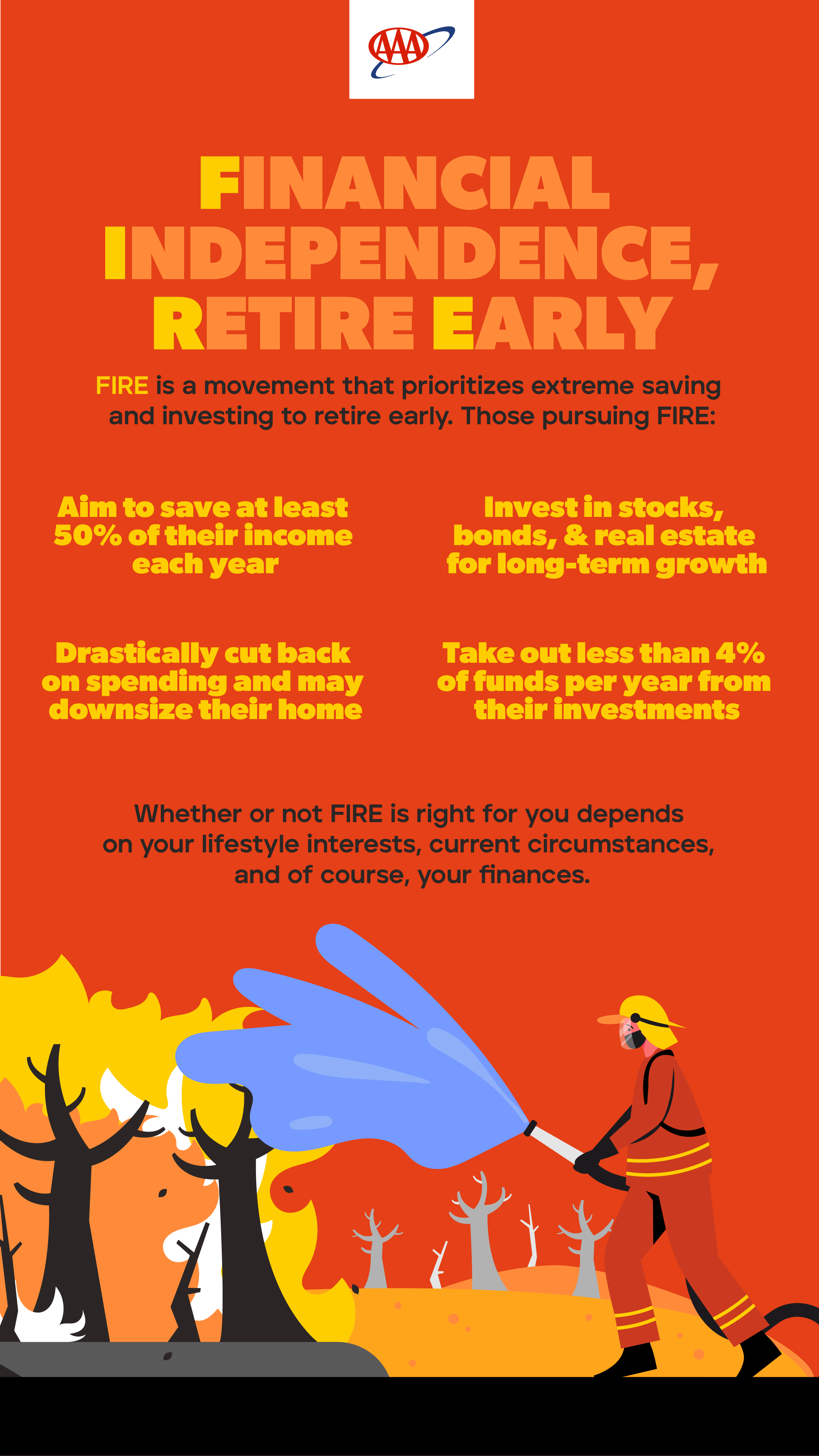

The interest in seeing financial freedom and an early escape from the traditional 9-5 isn’t new. However, in recent years, a growing number of people have decided to embrace the concept. That’s where the FIRE (Financial Independence, Retire Early) movement has gained momentum.

It’s centered on aggressive saving, smart investing and frugal living to achieve financial independence and retire years, if not decades earlier, than the standard retirement age. While it may sound like a dream come true for many, FIRE does have its complexities and challenges.

Here’s what to know about the FIRE movement if you’re considering this path to early retirement.

What Is FIRE?

The FIRE movement focuses on achieving financial independence—having enough savings and investments to cover living expenses without working. The “Retire Early” part centers on reaching financial independence well before the traditional retirement age of 65.

The FIRE philosophy emphasizes several fundamental principles:

- High savings rate: Those pursuing FIRE often aim to save a substantial portion of their income, usually 50% or more, to accelerate wealth accumulation. This frequently means cutting back on expenses to prioritize savings.

- Frugal living: Mindful spending and prioritizing needs over wants are central to the FIRE lifestyle. Proponents may downsize living arrangements, minimize debt and find creative methods of money management to save more.

- Investing for growth: FIRE followers invest savings in various assets to achieve long-term growth and help sustain their retirements. Typical investments include index funds, stocks, bonds, and real estate.

- The FIRE number: The amount that must be saved for financial independence. It’s often calculated by investing 25 times annual expenses. The idea is based on the 4% rule, which estimates you can sustain your lifestyle for 30 years by withdrawing 4% from investments yearly.

These principles are the foundation of FIRE, but variations have developed over the years to appeal to different lifestyles and needs.

Fact & Fiction

Fact & Fiction

Types of FIRE

While the core idea of FIRE stays consistent, there are different approaches you can take depending on your lifestyle, financial goals and risk tolerance. These variations usually fall into a few common categories:

- Lean FIRE: This approach involves extreme frugality, aggressive saving and minimizing expenses to reach financial independence as quickly as possible. Lean FIRE enthusiasts often embrace minimalist lifestyles, prioritizing low-cost living and aiming for a retirement with modest expenses.

- Fat FIRE: Individuals interested in Fat FIRE prioritize a more comfortable retirement lifestyle. While they still save aggressively, they may allow more spending on travel, hobbies and expenses. Fat FIRE often requires a higher net worth to meet higher spending levels in retirement.

- Barista FIRE: This is a hybrid approach. It involves working part-time, often in a low-stress job, to supplement retirement income and prioritize socializing. Barista FIRE allows people to retire early while still earning some income and staying engaged in the community.

- Coast FIRE: With this approach, an individual has saved enough to eventually reach their FIRE number without having to save as aggressively. So, they may continue working but want less pressure and more flexibility, knowing their financial future is secure.

Remember, these categories aren’t rigid, and people may blend certain elements and approaches to create a FIRE plan that works for their needs and preferences. Some may simply embrace the principles of cutting expenses, increasing income and saving more, which can help you reach similar goals.

If you’re looking for long-term guidance to improve your financial situation, a certified financial planner can help.

Learn more Getty

Getty

The Pros of the FIRE Movement

The FIRE movement has several potential benefits that may attract those who want to try a different path in life:

- Financial freedom and independence: Achieving FIRE means you don’t need to work for a paycheck. Financial independence can provide a sense of accomplishment and empowerment, giving you the freedom to pursue interests and passions without worrying about constraints.

- Early retirement: One of the most appealing aspects of the FIRE movement is early retirement. It can open up years, or even decades, of time to travel, volunteer, start a business or enjoy a slower pace of life with friends and family.

- Reduce stress and burnout: Many people experience anxiety and burnout from long hours at demanding jobs. FIRE can offer a path away from this cycle, allowing for a healthier work-life balance and lower stress levels.

- More flexibility and control: With financial independence, you can choose how you want to spend your time and energy, designing a life that aligns with your values and priorities.

Adobe

Adobe

The Cons of the FIRE Movement

While the FIRE movement has plenty of benefits for those interested, it’s important to also consider the potential drawbacks and challenges.

- High savings rates: Achieving FIRE often requires saving a significant portion of your income, which can mean drastic lifestyle changes and sacrifices that may not be feasible or desirable for everyone.

- Potential for burnout: The intense focus on frugality, budgeting and savings can become overwhelming for some, leading to burnout. FIRE also often requires long periods of intense discipline, which may be hard to sustain.

- Risk of underestimating expenses: Retirement can be unpredictable; it’s easy to underestimate how much money you’ll need. Unexpected expenses like healthcare costs or home repairs can derail even the most carefully crafted FIRE plan.

- Social isolation: Leaving the workforce early could lead to a loss of social connections and a sense of isolation for some.

- Missed opportunities: Retiring early could mean missing out on potential career advancement, salary increases and personal development opportunities.

It’s essential to weigh these pros and cons carefully to determine if the FIRE movement aligns with your values, goals, and risk tolerance.

Is FIRE Right for You?

The FIRE movement may sound appealing, but it’s not a one-size-fits-all solution. Whether or not it’s the right path for you depends on a variety of factors:

- Your values and priorities: FIRE requires a strong commitment to saving and frugality; consider whether this aligns with your values and if you’re willing to make these long-term sacrifices.

- Your financial situation: Your current income, expenses, debt and savings rate play a major role in determining if FIRE is feasible for you.

- Your risk tolerance: Investing is a key component of FIRE, and different investment strategies come with varying levels of risk and potential returns. So, understand your comfort level before investing.

- Your vision of retirement: Your retirement goals influence how much money you need to save and the type of FIRE path you choose.

You should also consider some of the practical aspects of your needs. For instance, how will Social Security benefits fit into your retirement income plans, and how do you plan to pay for health insurance costs if you no longer have coverage through an employer but don’t yet qualify for Medicare? Lastly, think about the potential psychological impacts as well. While some are well suited for aggressively saving over the long term, others may struggle.

Getty

Getty

Choose the Path Best for You

Remember, FIRE is a personal journey. So, before starting on this path, consider consulting with a financial advisor to discuss your circumstances and create a personalized plan. Also, realize your FIRE goals may evolve over time, so be open to adjusting your plans as circumstances change. Finally, FIRE isn’t the only way to achieve financial independence. You may want to explore other options like semi-retirement, career breaks or a less demanding job.

The FIRE movement is an alternative way to achieve financial independence and early retirement, but it’s not a decision to make lightly. Whether or not FIRE is the right choice for you depends on your circumstances, finances and lifestyle interests. As you consider your options, research, speak with those in the FIRE community, and weigh the pros and cons. That can help you make an informed decision based on your values and goals.